Fajarbaru Builder Group Bhd (“Fajarbaru” or “Group”) reported a net profit of RM55.47 million for the financial year ended June 30, 2024 ("FY2024”), swinging back into the black from a net loss of RM16.64 million a year ago. Driven by increased contributions from the Property Development segment, the Group's revenue was RM497.41 million, the highest since the Group's 1998 initial public offering ("IPO") and more-than-doubling from RM224.06 million for the year ended June 30, 2023 ("FY2023").

For the quarter ended June 30, 2024 ("Q4 FY2024"), the Group reported a net profit of RM4.50 million, compared to a net loss of RM20.23 million a year ago. Q4 FY2024 revenue was RM154.99 million, more-than-doubling from RM72.84 million in last year's corresponding period. This improved quarterly financial performance was primarily driven by the Property Development segment.

In FY2024, Fajarbaru's stronger financial performance was primarily driven by the Property Development segment, which reported a more-than-fourfold rise in profit before tax ("PBT") to RM96.51 million in FY2024, from RM21.05 million in FY2023. Segment revenue was RM306.23 million, a more-than-fourfold jump from RM70.52 million a year ago. The higher revenue and PBT were mainly attributed to the Vierra Residence @ Kinrara development, which recorded continuous incremental work progress as compared to a year ago.

Fajarbaru's construction order book totals approximately RM1.01 billion, with RM68 million allocated to internal development projects. The Group’s tender book stands at RM4.41 billion as of June 30, 2024.

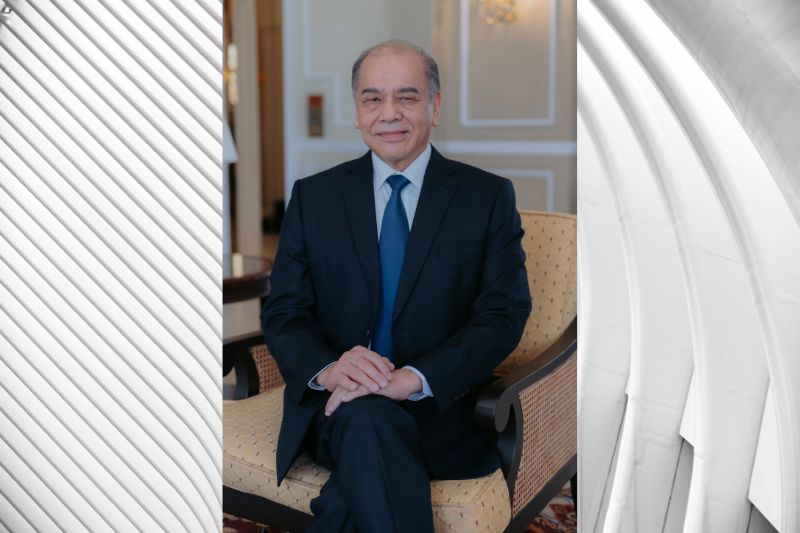

Fajarbaru’s Group Executive Chairman Tan Sri Dato’ Sri Chan Kong Choy said:

"We are pleased to report solid financial results for FY2024, driven by the improved performance of our Property Development and Construction segments. Notably, the Group achieved its highest revenue since our IPO in 1998, along with its best net profit since FY2018. Our strong performance is a testament to the steady interest in our real estate projects, along with our expertise and credibility in the construction industry.”

" We are proactively pursuing new opportunities by participating in tenders across both the private and public sectors. By capitalizing on our expertise in high-rise buildings, infrastructure, and railway projects, we are strategically positioned to expand our Construction orderbook. Our aim is to secure and execute major projects throughout Malaysia, reinforcing our commitment to delivering excellence across the nation.”

"In line with our long-term growth plan for the Property Development segment, the Group will work towards strengthening our brand reputation as a premier property developer. We will also explore opportunities to increase the size of our land bank through strategic acquisitions, supporting future development projects.”

"As we enter FY2025, we will focus on sustaining our revenue growth by capitalizing on new opportunities throughout our diverse segments, namely Construction, Property Development and Plantation. We look forward to another strong year of growth."

#MalaysianBusiness #Fajarbaru #FinancialResults #Profit #Revenue #PropertyDevelopment #Construction #KualaLumpur