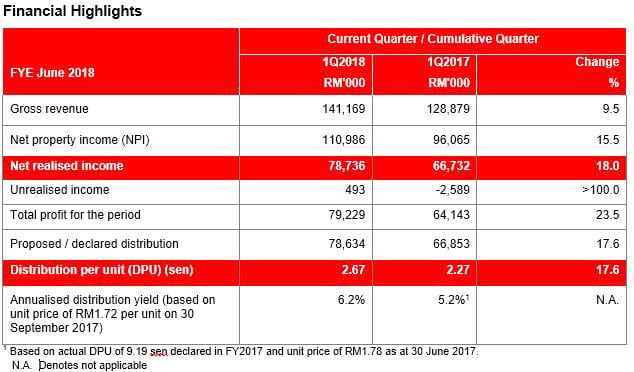

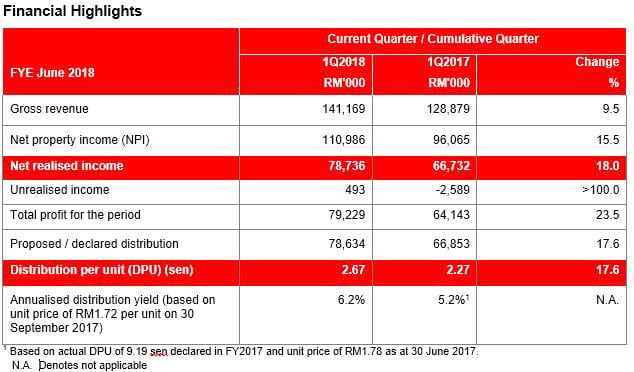

Sunway REIT started the financial year with an encouraging set of financial earnings in the first quarter of financial year ending 30 June 2018. Revenue increased by 9.5% year-on-year (y-o-y) to RM141.2 million, mainly contributed by higher revenue across all segments. Net property income (NPI) expanded at a stronger rate of 15.5% y-o-y to RM111.0 million on the back of higher revenue and lower property operating expenses.

The retail segment recorded a healthy growth in revenue and NPI underpinned by high average occupancy rates for all retail malls in the stable of asset portfolio, mainly due to higher average gross rent for Sunway Pyramid Shopping Mall. Revenue rose to RM103.6 million for the quarter ended 30 September 2017. In comparison to the corresponding quarter in the preceding year, revenue improved by 3.9%. NPI increased by a higher quantum of 9.4% in 1Q FY2018 to RM78.3 million on the back of higher revenue and lower property operating cost.

The hotel segment reported a stronger financial performance for the quarter ended 30 September 2017. Revenue and NPI increased by 40.9% y-o-y and 43.7% y-o-y in 1Q FY2018, primarily attributable to full resumption of operation at Sunway Pyramid Hotel following the completion of its refurbishment in June 2017. In addition, Sunway Putra Hotel enjoyed higher average occupancy and average daily rates during the quarter, benefitted from higher demand from the SEA Games 2017 and ASEAN Para Games 2017 held in August and September respectively.

Meanwhile, the office segment reported a revenue and NPI growth of 8.1% y-o-y and 8.5% y-o-y respectively, largely attributable to higher average occupancy rates at Menara Sunway and Sunway Putra Tower.

For the quarter ended 30 September 2017, the Manager proposed a DPU of 2.67 sen, representing an increase of 17.6% compared to the corresponding quarter in the preceding year.

Datuk Jeffrey Ng (pix), CEO of Sunway REIT Management Sdn. Bhd, commented, “I am pleased to share the encouraging sets of financial earnings which is in line with our expectation of a firmer year in FY2018. We are confident that the asset enhancement initiatives (AEIs) which we had undertaken in the last several years are showing encouraging progress in performance despite the continuous challenges affecting the property market / sub-sectors.”

Sunway REIT announced the proposed acquisition of the mixed-use Sunway Clio Property comprising a 4-star hotel, a retail podium and car park bays for a purchase consideration of RM340 million on 3 August 2017. Upon completion of the acquisition expected in 3Q FY2018, Sunway REIT’s combined property value will increase to RM7.12 billion, achieving our target of RM7.0 billion. The proposed acquisition of Sunway Clio Property was approved by unitholders at the Unitholders’ Meeting held on 25 October 2017.

Sharing on the prospect of Sunway REIT, Dato’ Jeffrey further commented “Barring any unforeseen circumstances, we expect Sunway REIT’s DPU to grow moderately in FY2018 supported by moderate growth in the retail segment, resumption in income contribution from Sunway Pyramid Hotel following the full completion of its refurbishment in June 2017 and gradual improvement in the overall occupancy of the office segment. In addition, we expect new income contribution from the recent acquisitions to contribute positively to the DPU in FY2018 and beyond.”